Small businesses post-pandemic get saved and secured by low-interest loans

At least, that is what the statistics show and what the experts suggest. The market in Europe, influenced by inflation in recent times, has seen much change. Reports state that the lending organisations, including direct lenders and banks, have stepped forward to help businesses to fight this situation. According to these financial institutions, the Small …

Continue reading “Small businesses post-pandemic get saved and secured by low-interest loans”

Getting a loan is easy, but first, weigh your options carefully

Your expectations always drive you. What you want forms the basis for the majority of your decisions. This also includes the financial choices that you make. Challenges are sure to come when you endeavor towards making your expectations a reality. It could be anything from the shortage of sufficient cash, impractical goals, no focus or …

Continue reading “Getting a loan is easy, but first, weigh your options carefully”

Budgeting rules to follow to master your money

There are no fixed budgeting rules suitable for everyone as everyone’s financial situation varies. Budgeting does not mean tracking your spending to overcome overspending, but it means saving, investing, making strategies to achieve your financial goals. Although you can find numerable tips about budgeting on the internet, you need to pick the one that works …

Continue reading “Budgeting rules to follow to master your money”

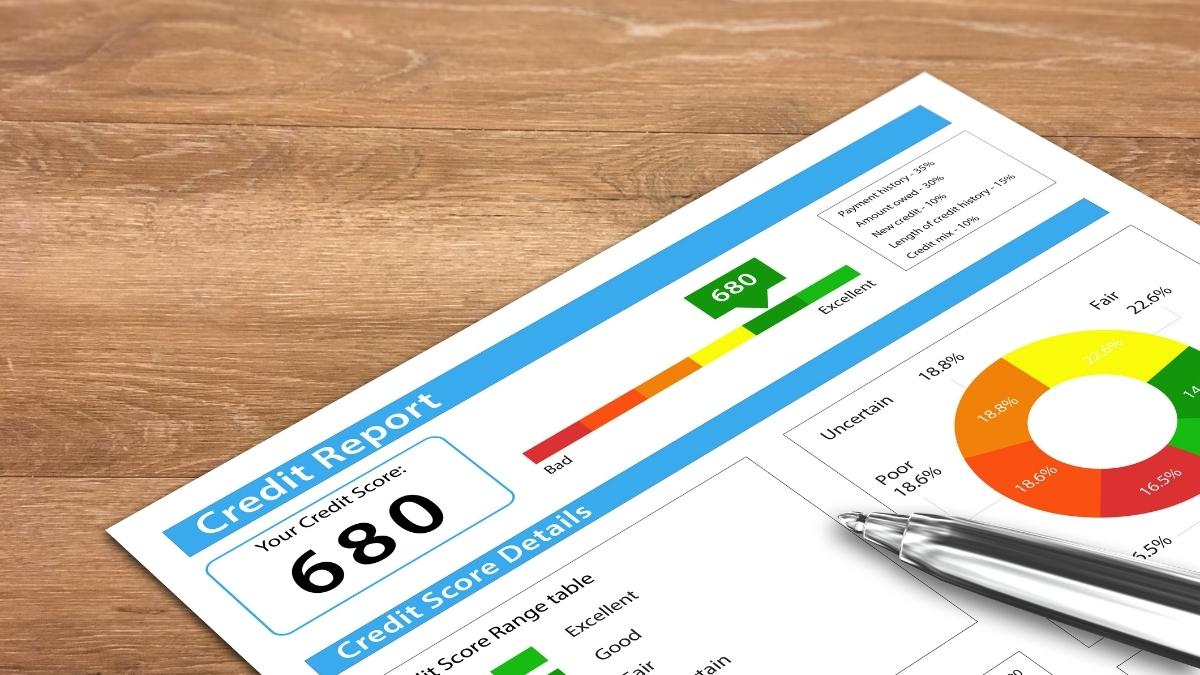

What can you do to improve your credit score with a ccj?

Moneylenders these days offer CCJ loans to various borrowers. CCJ is known as a country court judgment. This is a court order issued against any defaulter who cannot repay their debt to the franchise institution, bank, or any lender. If you are being issued with a CCJ, it means you have committed a serious mistake. …

Continue reading “What can you do to improve your credit score with a ccj?”

Why is it compulsory to maintain a healthy credit score?

Survival is possible with a low credit score, but it is not always easy. If you plan to buy a loan with a battery, you may have to face many difficulties and problems. Also, the loan may be very expensive for you because of your credit score. Establishing a good credit score helps you save …

Continue reading “Why is it compulsory to maintain a healthy credit score?”

8 Steps to take after mortgage loan rejection

Having your mortgage application denied can be a frustrating and irritating experience, especially when you dream about securing the keys to your home. For approving a loan application, lenders conduct multiple credit checks. Depending on the type of loans you seek, such as mortgage loans, bad credit loans ,instant decisions, no fee loans, or personal loans, lenders …

Continue reading “8 Steps to take after mortgage loan rejection”