Yes, it is true that poor credit situation frustrates a lot and a continuous desire to get rid of it, resides in you. The fact is, keeping desires is not sufficient, one needs to work to materialise them. You too should do the same and you are not the only one on the planet with having such problem. In a way, it is a good thing, because when something affects too many people, it becomes vital to find a solution. Easy Advance Loan is also one of the circumstances that is annoying countless people and affecting their financial decisions.

Hopes come there where hopelessness resides. For every problem related to bad credit situation, a solution is present. But the poor credit situation has many aspects and to get the most related solution, it is important to talk about all of them.

Reasons for degrade in credit rating

Before you work on a way out of poor credit, it is important to know the exact reason of the poor credit rating. Some of the most known reasons are –

- When you fail to fulfil the terms of a credit agreement. Every information about such things appears on your credit file. Example for this can be – making late loan repayments or credit card payments.

- Being declared bankrupt, having a County Court Judgement (CCJ) against you.

- Making minimum monthly repayment on credit card can also affect your creditworthiness. Lenders assume that you are struggling in your finances to clear your debts.

In any of the above situations, it is advisable to talk to your lender and ask for the help.

Does The Bad Credit Stay Forever On The Credit File?

No, not forever, the bad credit does not stay on your credit records forever. The CCJ, Bankruptcy and Individual Voluntary Agreements stay for maximum 6 years on the credit file.

Information of your credit history comes from 4 main sources

The credit reference agencies maintain your credit history and take information from the following sources:

- Court Records – This shows the information if there is any County Court Judgement or any bankruptcies against you.

- Search data – This includes the details of the lenders that have searched your credit file when you applied for some credit or loan product.

- Fraud data – This confirms the presence of any fraud from your side. Also, if someone has stolen your identity to commit any fraud.

- Electoral roll information – This has your address and also the information of who lives with whom.

Possible solutions for bad credit

Now come to the escape windows that can help ease the struggle with bad credit situation.

- Specialised Online Short term bad credit loans –

Online lending is a synonym for specialised lending. Lenders purposefully offer

some loans that help people improve the credit score. For instance, the bad credit loans without a guarantor. These are (as you can read) obligation-free short-term loans. You cannot only borrow funds during bad credit but can also improve the credit rating. How? Through customised pricing. The lenders intentionally keep the loan offer customised as much as possible. The aim is to help the borrower pay the instalments on time as timely payments of debt improve credit scores.

- Other quick suggestions to transform bad credit into good

Some efforts are required from your side much before you take a loan. To qualify for a loan also, it is good if your credit record shows some improvement.

- Check the information on your credit file

It is very important to know what exactly your credit file contains. The information on it is correct or not. To check the credit file, you can go for free trials or can pay a small fee. If there is any wrong information, then contact the lender and get it removed. For every responsible and financially literate person, it is necessary to know what details are present on the credit records. They are the mirror image of your financial behaviour for the finance industry and that should be perfect.

- Get disassociated from your financial partner

When you open a joint bank account or take a join mortgage with someone else, you are financially linked with that person. The credit score status of your partner can affect yours. Also, if you have split up with that person, then it is the time to separate the financial associations. Otherwise, your finances can stay affected for whole life and can restrict your liberty to take your money related decisions.

- Close the unused store cards, credit cards and direct debits

Amount of credit that you have access and also the amount of debt that you owe are considered by the lenders. Close every credit account such as store cards, credit cards, and accounts that you do not need or use anymore. Every bit of your financial behaviour has an impact on the credit records, take every step with caution.

- Pay off the debts and not just the minimum amount

Paying the minimum amount of debts such as credit card payments does not mean that you can stay away from bad credit. This in fact adversely affects your credit rating. Pay off your debt completely as it is considered as the good behaviour by the prospective lenders.

These way outs can help you get an even more access to funds through the loans for bad credit with no guarantor. Approval can become a cakewalk.

TO BE PRECISE, if you want to improve bad credit situation, then it is necessary to first, take a detailed overview. Second, understand the varied aspects of bad credit history.

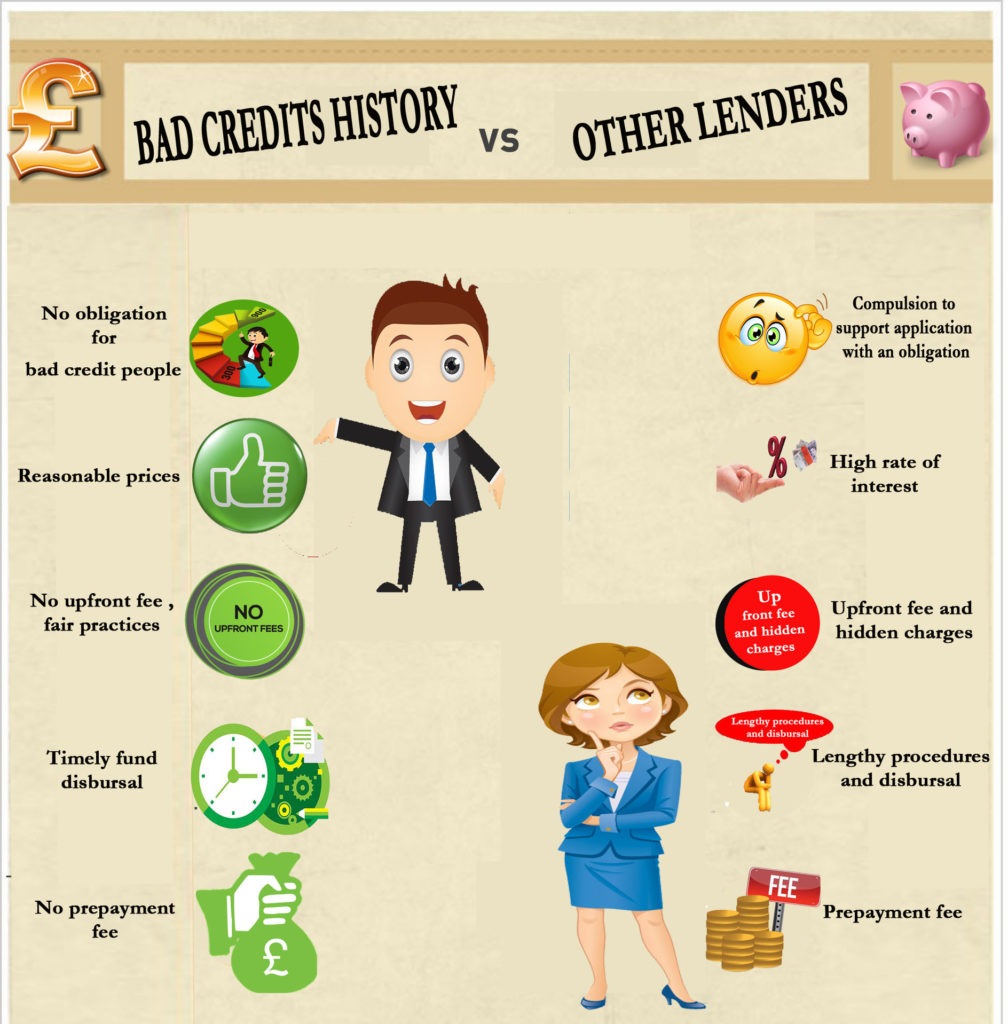

A comparative study of what easy advance laon provides that is difficult to find with others

The infographic below is a hint of what you deserve in a good loan deal. Also, what a genuine lender provides. If you do not find that in a loan offer, then it is always good to switch to the other option.

Responsible lending comes with fair practices. The above comparison is perhaps good to make you understand the difference between the GOOD and the BAD lending. It can help in taking a calculative decision when you search for the lender or a loan.

Calm and Calculative mind is necessary to get rid of the poor credit situation. In addition, it is of utmost importance to know every nook and cranny of the circumstances that relate to bad credit situation. Financial literacy is the vital pillar of a strong and prosperous life. Being a responsible person, it is your responsibility to do things on your own and that too perfectly.

Last but not least, be a responsible person

Finally, when you come out from poor credit situation, make sure that this time nothing goes wrong. There is a need to do a lot to keep the finances in control otherwise it can affect a major part of your life.

Related Blog

How do high-Acceptance Loans help credit rating?

Loan Advice: Tips on getting no broker bad credit loans

Becoming a Guarantor? Consider Reading these Points before Doing it

How can you Fund your Small Business with the Right Loan Option?

I Want Cash Delivered to My Home Within 30 minutes. What is my Option?

Emily Rhodes operates as a Senior Content Writer at Easyadvanceloan for 5 years. She oversees the financial planning and monitoring of the cash flow. Emily also helps the firm forecast its financial standing by analysing the operational data and latest reports. It requires detailed research and predicting the trends before arriving at a conclusion. Emily Rhodes’s credible predictions and the best usage of problem-solving and analytical skills help the firm revise financial policies for growth. She ensures the best of her expertise by working in tandem with the CEO and Chief Operating Officer. Academically, Emily is a postgraduate with MBA in Finance from a reputed university.